The 5 Ws of fundraising for businesses

Originally published on Notion.

As an entrepreneur, you might be wondering “I’m doing everything that an investor wants, but am still unable to raise funds for my business. Am I doing everything correctly? What am I missing?”.

This a common grievance we hear as investors from entrepreneurs and to-be entrepreneurs irrespective of various sizes and stages of a business. Why is this the case? For starters, not all businesses are suitable for generating returns for external investors. And more generally, today there are more businesses than there are funds to invest in them. Typically, less than 10% of all startups in India have gotten funded.

We have split article this into five sections covering the Why, What, Where, When, and Who. All these are influenced by the type of business and the stage of business you are running. For example, your business could be a product (like Fitbit), a service (like Ola), or a combination (like Amazon).On the stage front, you can either be at the stage of idea, prototype/minimum viable product (MVP), market pilot, category leader, or market leader.

The Why

Have you carefully evaluated why you need money for your company? The obvious answer is to grow the company but are you clear on how that will happen? We have seen that sometimes entrepreneurs pitch with an ask of X crores and a split of say 40% for product development, 40% for marketing and sales, and the rest for ops. But when a clarification is sought to understand what they will do with the 40% on marketing, there would be a non-specific reply like “We will use it for online marketing.” Investors like to see clarity of thought. So, it is advantageous to have a strategy of the marketing- who will you hire for the marketing/ branding role, what kind of experience and profile would you look for, why do you prefer online marketing and how much is budgeted for social media ads, how many customers are expected to be acquired with that spend, etc.

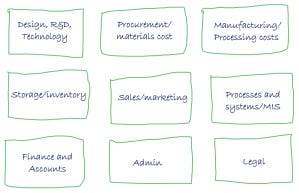

Zooming out a little, there are multiple functional aspects of business that the money could be deployed on. It is crucial to be clear on what you expect to spend money on and how much because from the investor’s point of view this would make the ‘Why’ of you’re raising money.

Here are some functions you should keep in mind while thinking about the Why:

Depending on the sector/industry that your company operates in, there may be other costs you need to budget for. For example, healthcare businesses may need to spend on clinical trials, education businesses may need to spend on accreditation / licenses, etc.

Once you have the nitty-gritties of how much you need, for what and how you plan to spend the money figured out, it’s good to also pen down the expected outcomes from each of the spend. For example, with the one crore spent on R&D, you expect that the MVP will be ready in a timespan of 12 months.

The key takeaway for entrepreneurs is this: be clear on what functional aspects you are raising money for and what outcomes you expect to achieve after spending it.

The What

What type of capital are you going to raise? Is it going to be grant, debt funding or equity funding? Each of them caters to different needs of the business and has different risk appetite & return expectations.

Selection on the type of capital should be looked at along with the Why, sector and stage of business. For example, a healthcare company making hardware devices at a development stage may not be suitable for venture capital (VC) funding as the development to commercialization phase is longer than the cycle of investment and delivering returns. VCs typically have a 10 year fund cycle in which both fund deployment and exit needs to be done which would not fit in this time frame. This is why, chances are you’ve heard a venture capitalist say “It’s too early for us to invest”.

More suitable in this case, would be to approach a government funded research grant which typically funds companies in the development phase aiming to take their idea to a prototype. Typically a product development cycle is 3-4 years for a healthcare hardware/device company and the uncertainty in this timeline is also not suitable for a VC. On the other hand, a company developing software can get through the development phase quickly and is more amenable for VC funding vis-a-vis hardware devices. Depending on the sector, it needs to be looked at in a nuanced manner.

More structurally, here are the considerations for you while deciding what kind of funding you should raise

Grant/ Non-dilutive capital

Any company which is in the development phase that carries an inherent risk of product-solution fit and product-market fit not established should look at grant/ non-dilutive funding. Through this, the entrepreneurs’ personal economic loss will be limited in case the product fails in the development phase.

Any company which has a superior product/ service which is well established but there are certain segments/ markets that they do not cater due to their unviable nature could also look at grants. There are potential grant givers/ partners who will be interested in developing those markets and encourage these companies to cater to and develop these markets. Example: Considering positive environmental impact, governments across the world gave grants and subsidies to companies to promote solar technologies. Through this example, it is important to note here that grants are not just restricted to early stage impact businesses and nonprofits/civil society.

Grant money by no means is free money. Though it is non-dilutive in nature, it comes with specific expectations and outcomes from the receiver. If an EdTech company receives a grant from a philanthropic foundation, they will be expected to deliver certain learning outcomes among the children in the school(s).

Equity

Equity as an asset class is expected to produce an outsized return for investors. The return expectation varies significantly depending on whether the equity lender is an individual, private institution or government. Invariably no one wants to see their investment multiplied less than a safe bank deposit and/ or Government bond.

The second important element in equity as an asset class is the time frame within which the returns need to be generated. Most of the VC funds, as discussed, are operating in a 10 year time period (of deploying and generating returns) hence businesses that are perceived / can massively expand & generate cash/ increase value in a short-time frame are the ones that end-up getting this money. Example: A standalone retail fashion store which may be popular in a place may be giving over 10% returns to its promoters but when an external equity is infused it comes with an expectation of inorganically expanding it, which the promoter and business may not be ready to do. Hence, the promoter(s) have to weigh their choice of taking equity in their company given the time and return pressure it brings.

Debt

If the company is cash flow positive

Minimum revenue

Networth positive

With assured paying customers, can even do bill discounting (described below)

If, at this point in time, any of the above types of capital is not right for you, then generating revenue from customers is the ultimate form of funding. This is how traditionally businesses have been built in India and across the world!Key takeaway: think carefully of what a funder expects and what the business is capable of while deciding whether to go for grant, debt, or equity funding.

The Where

This aspect is very closely connected to the What of fundraising. Put simply, here we will discuss where the capital will come from or who the funder will be and some considerations for each.

Grant

All the above sources of grant capital have their own requirements / expected outcomes depending on the mandates of the funder.

Friends and family may have expectations of return. Therefore, it is good to set expectations for them at the time of investment both in terms of money returns and the timeline. This means you should clearly explain the downside of the investment.

Also, having this captured through a formal agreement is critical. This will ensure that the relationship doesn’t go sour.

Angel investors

Active angels- angels who, for example, lead strategic partnerships for the company along with the capital they bring in. Essentially, they play a large decision-making role in the company.

Passive angels- largely just a capital provider; low touch involvement

Here, it’s recommended to have strong references for the investors. Have they worked with someone you know? How helpful are they in times of distress?

A growing trend is that many angel investors are now being aggregated by angel platforms and Micro VCs.

VCs

Sector-specific investors: e.g. Education focused, FinTech focused, Agri focused

Stage-specific : Seed/ Pre-series A, Series A, B, C and so on…

Technology-specific: Artificial Intelligence (AI), Machine Learning (ML), Software as a Service (SAAS)

Geography Specific: Continent focussed (Asia), Country Focussed (India), Emerging market (South & South East Asia)

Special Case focused funds: Social impact, Critical infrastructure

VCs can be one or a combination of the above. VCs typical cheque size can range from $100k (pre-seed/seed stage VCs) to around $20M(growth stage).

Private Equity

Growth: these funds acquire minority stakes in growing, high potential companies.

Leveraged buy-out: LBO funds typically acquire controlling stakes of mature, cash-flow-stable companies. They do this partly with their own money and partly by borrowing debt from another institution (hence the leverage).

Private equity funds typically invest upwards $20M in mature businesses. The parameters that are evaluated by PEs are largely if the company is profitable and if can potentially become a listed company.

IPO

SME (see eligibility criteria here)

Regular BSE/NSE

Debt

Banks: The risk appetite for banks is low compared to that of equity financiers. Hence, their return expectations (i.e. your cost of capital) is also low. A majority of businesses who borrow are reasonably established in that they will have positive cash flows to service interest and also assets to pledge as collateral. Banks are also sometimes constrained by giving out debt to businesses around their nearest branch/ circle of servicing. However, there are special schemes like Credit Guarantee Fund Trust for Micro and Small Enterprises (CGT-SME) through which banks give collateral-free loans. Of late, there are banks which have initiated start-up banking through special branches to increase their lending to new businesses. Typically, the interest rate is in the range of 7% to 15%.

Non-Banking Financial Company (NBFC): The risk appetite is slightly higher than a bank hence cost of borrowing is also higher. They offer specialized financing products like bill discounting. A company may have received orders from a credible customer and they may not have sufficient working capital to fulfill it. Based on the bill amount, NBFC gives a short-term credit to fulfill it. Some of these customers who are receiving a bill discounting product need not be profitable hence they are different from a bank and its customers. Typically, the interest rate is in the range of 15% to 23%.

Venture Debt: This is an emerging asset class. As the name suggests, it is given to companies which have an institutional equity investor(s) and it is growing rapidly. Returns to venture debt providers are capital and interest rate payment and a small portion through equity when they raise the next round of equity funding. Promoters and companies enjoy the benefit of not diluting their equity for want of working capital in their business and interest rate is low when compared to an NBFC. Typically, it comes between Series A and D. Promoters, therefore delay giving away equity too soon for capital needed.Special Cases: There are new types of capital emerging which are a blend of some of these. For example, crowdsourcing platforms where a business can showcase their innovative product before beginning manufacturing at scale. If it interests the audience, businesses can avail capital through it either as debt from its investors or as order advance for shipping their product to the interested customers.

Key takeaway: within each class of funders, there are multiple types of funders. Approach the right type of funder depending on the stage and type of business you have.

The When

A minimum of 6-9 months from the time of taking the decision of going ahead with the process to getting the money in the bank. In some cases, like a friends and family round or angel round, the timelines can be shorter. Here, it’s recommended that enough money is raised for the next 12-18 months at least, so that you can focus efforts on running the business itself, rather than on fundraising.

The timeline also depends on the readiness of the company for diligence by external investors & borrowers. Be it equity, grant or debt providers, they will do diligence on various aspects like business, financial and legal before taking a decision on lending/ investing. Faster the turnaround of companies when investors/ lenders seek these info and data (on legal, business & finance), faster the decision to lend or invest.

The Who?

Who can help you in the capital raising process? It is a specialized job and it’s important to invest time and money to achieve the desired outcome.

Mentors/Advisors who have gone through fund-raising process themselves or have supported it in the past

Incubators/Accelerators

Investment Bankers

Investment Platforms

Lawyers/CAs

It is recommended to seek advice from professionals as mistakes in structuring the deal can turn out to be very costly for the company. For example, let’s say a company gives upwards of 35% equity in the initial angel round itself. When VCs look to get a 15-20% stake in the company in the subsequent round, promoters already would have become a minority. Giving away too much too early would mean that the promoters would lose most of the control and incentives (skin in the game) in the company too soon. In this case, a right advisor would have benchmarked the round according to market standards and structured the deal.

That’s all folks!

If you’re looking for support during your fundraising process, please feel free to reach out to us on our emails below- we’re happy to guide and advise you.

About the Authors

A B Chakravarthy is a seasoned venture capital professional with over a decade of experience in emerging markets in sectors like agri, energy, skills, waste management, ICT, health, water & sanitation. He can be reached through abcmonarch@gmail.com

Aditya Jahagirdar works in the investment team of Ankur Capital, an early stage VC fund focusing on the next billion markets. He can be reached at aditya.jgr@gmail.com

Views expressed here are personal. Readers’ discretion is advised.